Senior Political Reporter

Government’s Landlord Business Surcharge will carry strong penalties for non-compliance, including for landlords collecting rent from premises and failing to register those premises. Such landlords will be subject to a $250,000 fine plus three years’ imprisonment.

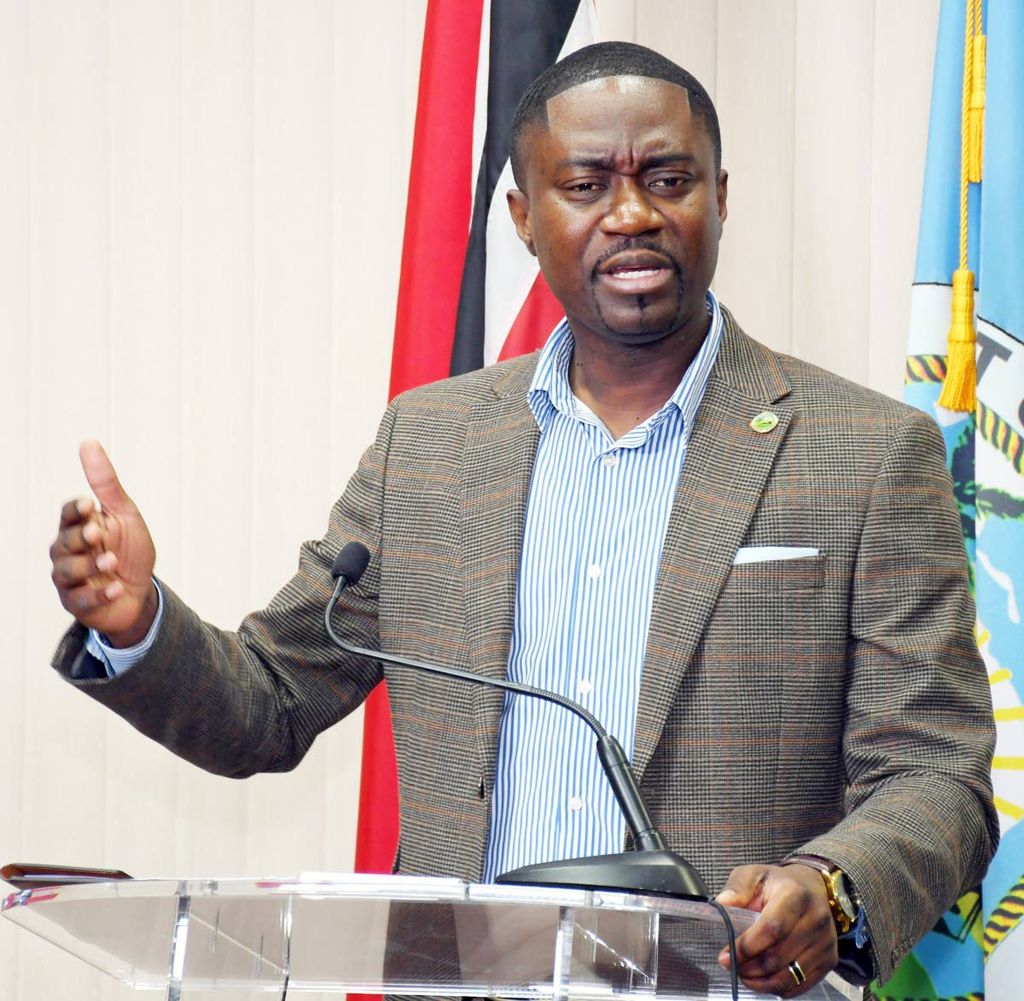

Landlords who knowingly supply false information to the Board of Inland Revenue will also be subject to this penalty, Finance Minister Dave Tancoo stated in the House of Representatives on Friday.

This was during debate on the Finance Bill 2025, which he piloted. The bill implements items from the 2026 Budget, whose start date is January 1, 2026. It was passed with amendments.

Tancoo, in debate, added, “By definition, if you are renting a property from someone and that property is generating an income —that is a commercial activity, and that’s what this legislation is designed to focus on.”

He said the surcharge ensures that the landlord sector is formalised, transparent and accountable.

“It helps ensure that landlords who benefit from rental income contribute appropriately to national development, while establishing a modern compliance and enforcement framework that protects tenants, supports fairness and strengthens revenue administration.”

“We’re confident that this tax is much more equitable than the PNM’s dreaded Property Tax because it is calculated on actual rental receipts as opposed to the PNM’s fictional rent.”

The surcharge requires all landlords to register with the Board of Inland Revenue the premises they intend to rent within three months of the commencement of this surcharge, and to pay a one-time registration fee of $2,500.

Upon registration, the BIR will issue a certificate of registration for each property, and a public register will be maintained for inspection.

Tancoo said the surcharge itself is to be paid on a quarterly basis and is calculated at a rate of:

– 2.5 per cent of gross rental income where quarterly receipts are $20,000 or less, and

– 3.5 per cent where receipts are above that threshold.

Tancoo added, “This surcharge applies equally to rental income received in foreign currency, ensuring uniform treatment across all forms of rental earnings.”

Quarterly filings and payments must be made by the prescribed dates.

Tancoo said penalties and interest apply for late filing or late payment. The BIR will have full enforcement powers under the Income Tax Act, including the power to audit, recover and enforce outstanding surcharge amounts.

Certain properties will be exempt from the surcharge: the State, State-controlled enterprises, hotels already subject to the hotel accommodation tax, and charitable, educational and religious institutions approved under the Corporation Tax Act.

Tancoo added, “There is nothing in this surcharge similar to the PNM’s Property Tax, which was a penalty against people owning property as it was based on a fake zero-income model. Many who didn’t rent their property complained bitterly of unfairness … the heartless PNM even threatened to take people to court on that …”

On increases in penalties for driving offences, Tancoo said this is necessary to compel careless drivers to be more responsible, and to protect the entitlement of victims to insurance compensation from offenders. “But the PNM says no …” he noted.

He also said the law will allow for a new BIR Board to comprise six public officers from the Inland Revenue Division instead of the previous five, and will now include an attorney with at least ten years’ experience, an accountant with at least ten years’ experience, and a Permanent Secretary in the Ministry of Finance as an ex officio Commissioner.

“The President will appoint the professional members and the Permanent Secretary, and the Chairman will continue to be selected from among the public officers of the Inland Revenue Division,” he added.

Tancoo clashed with Opposition MPs on what he called “PNM misinformation,” including former Minister in the Ministry of Finance Brian Manning, who told Tancoo not to call his father’s (Patrick Manning’s) name. Tancoo appealed to the PNM not to circulate “fear tactics and fearmongering as they seem to be anxious to do …”