Senior Reporter

geisha.kow[email protected]

The passage of the Finance Bill 2025 through Parliament late Friday has sparked debate among the nation’s leading economists, as they weigh the government’s need to increase revenue against the potential financial burden on the average citizen.

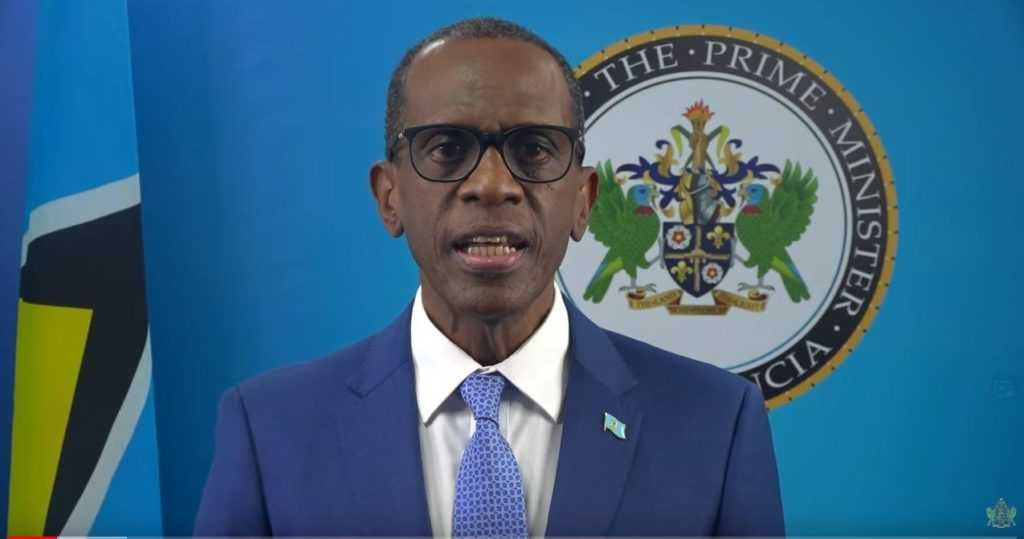

Finance Minister Davendranath Tancoo championed the Bill as a decisive step toward strengthening governance, modernising outdated laws, boosting public safety, and ensuring fairness in Trinidad and Tobago’s tax system.

Economist Dr Ronald Ramkissoon cautioned that while revenue generation is important, it must be balanced with expenditure control and efficiency improvements.

“T&T has been running deficits for an extended period, so addressing revenue is a logical starting point,” Ramkissoon said. “However, poorly designed measures could have unintended consequences. Taxation operates within thresholds; if these are exceeded, expected revenue gains may not materialise. In fact, revenues could decline as economic activity contracts. For example, high taxes on rental properties could restrict supply in the housing market.”

Meanwhile, economist Dr Indera Sagewan said the Finance Bill 2025 was designed to implement revenue-generating measures proposed in the 2026 budget.

“The proposed expenditure of $59 billion has to be financed, and given the continued decline in energy rents, the Minister had two choices: slash expenditure or raise revenue through new and increased taxes. He chose the latter,” she noted.

Sagewan said the key question is whether these new taxes were designed to minimise the burden on the average citizen, who has faced increased financial strain over the past decade.

“Let us not forget reductions in the gas subsidy and GATE cuts,” she said. “Having decided not to cut expenditure, Minister Tancoo had to determine who to tax. Taxes on alcohol and gaming are effective because demand for these products is inelastic—people continue buying despite higher prices, as confirmed by CNC3 research.

“Increased fines for illegal gambling are also welcome, addressing the underground economy, provided enforcement mechanisms are in place.”

Addressing concerns that the electricity surcharge and new landlord rent surcharge could be passed on to consumers and tenants, Sagewan acknowledged the risk but described it as calculated:

“The minister can only hope that industry absorbs part of the increase. As for landlord rent, this is currently a substantial tax leakage. The measure captures unpaid taxes from landlords who are not paying. With the current surplus of rental properties, tenants can shop around if a landlord passes on the tax.”

She added that any tax-driven revenue measure inevitably imposes a burden on targeted taxpayers.

“In fairness to Minister Tancoo and the new UNC government, the burden has been shared more equitably than in the past. He inherited an economy with little financial wiggle room and, for the most part, eased the burden on the average citizen.

“He reduced the price of super gas and removed VAT on a range of basic items, so the average citizen will not be worse off due to these tax measures,” Sagewan concluded.