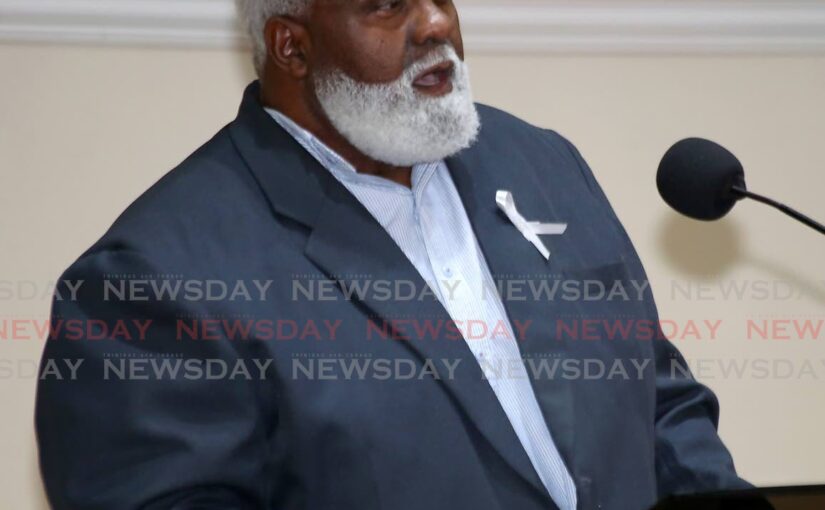

From left, Taharqa Obika, shakes hands with PNM PRO and Government Senator Laurel Lezama-Lee Sing. -

TRADE and investment consultant to the Ministry of Trade and Industry Taharqa Obika does not subscribe to floating the TT dollar.

Adding his voice to the argument, the economist, former banker and former UNC senator believes doing so would cause pain to fixed-income earners, as it would result in higher inflation.

Finance Minister Colm Imbert believes the dollar should be maintained at its current exchange rate, which stands at US1$ toTT$6.79.

Other financial pundits believe this is the answer to bring about some stability in the face of current declining access to foreign exchange, reduction of the US$ amounts banks are now allowing their customers and managing the black market.

Obika explained in a release, “A free float of the TT dollar will be bad news for pensioners and other fixed-income earners such as public servants and minimum-wage earners.

>

“The truth is essential goods and basic food supplies are largely purchased by entities that obtain US$ at the official rate. This conclusion about the black-market rate will drive inflation ignores this fact.

“A free float will mean even the companies that import rice and peas who benefit from the forex facility for essential goods, as well as manufacturers of essential goods that get access to the official forex facility, will be paying upwards of ten-15 per cent more for their US$.”

He foresees the conversion of imported petrol at the pumps will mean an instant increase in fuel, driving the price upwards, from a taxi ride to groceries at the supermarket.

“This combined effect will cause an instantaneous rise in the price of every imaginable basic commodity. The pain will be immense to everyday persons and cannot be deemed to be an acceptable solution.”

Instead, he suggested, “A managed rate, where we defend the currency at a target exchange rate, is the best plausible response at this time.”