Senior Investigative Reporter

Shaliza.has[email protected]

The Government’s move to impose taxes on local artistes will be addressed by the Trinbago Unified Calypsonians Organisation (TUCO) after Carnival 2026.

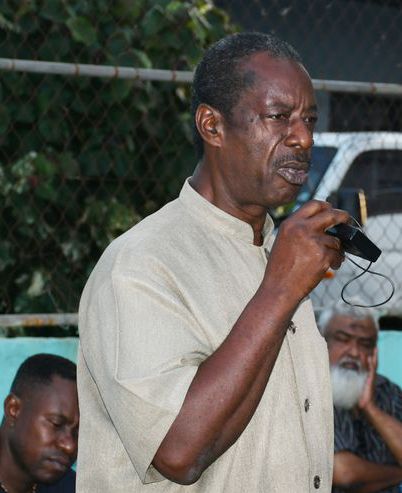

This commitment was given by TUCO’s president, Ainsley King, during an interview with Guardian Media, as the first attempt by the Government to get stakeholders to pay taxes on monies earned for Carnival, more than a decade ago, had failed.

On January 12, the Inland Revenue Division (IRD) of the Ministry of Finance advised promoters, bandleaders and local and foreign artistes of their obligations to pay their required taxes during the 2026 Carnival season.

The IRD also advised that it would conduct field visits to stakeholders to ensure their tax obligations are paid.

In a statement, the IRD informed promoters that they are required to register for VAT, having earned gross receipts of $600,000 as of January 1, 2023.

They also have to pay income tax, corporation tax, green fund levy and deduct and remit withholding tax for foreign artistes, as well as submit returns.

Similar taxes and submissions have also been imposed on bandleaders.

In the case of registering for VAT, where gross receipts of $600,000 is attained, no date was given for bandleaders.

While local artistes would have to pay health surcharge, income tax and submit returns, foreign artistes were informed that they would be liable for withholding tax deducted and remitted by promoter/s.

“We will have to face it. And then I know the concerns and discussions will start taking place,” King said.

He said it’s an issue they can’t avoid, which they would look into after the Carnival season.

“If it’s something that is going to become law, then we would have to make adjustments to deal with it. As soon as the Carnival period passes and people’s consciousness comes back, then they would deal with it.”

He said the taxes are being introduced when artistes are engaged in nightly performances leading up to Carnival, and they may not pay much attention to this latest development.

At least two promoters, Randy Glasgow and George Singh, said they have been VAT-registered for years and are compliant with the law.

‘Taxes a thief in the night’

Three bandleaders, Leo Lakhan, Rickie Davidson and Morgana Beach, said these taxes came like a thief in the night.

Davidson of Wee Mas International said sometime in 2011, the then People’s Partnership government tried to implement taxes on bandleaders, but it fell flat.

He was interviewed by the Ministry of Finance concerning his earnings, but there were no follow-up discussions.

In his 17 years of operation, Davidson never paid taxes on his band.

“You know, you can’t pay taxes if you’re making no money.”

The 100 people he expected to register in his small band this Carnival have fallen short.

Davidson had to cut his six sections to five.

Leader of Beach and Associates Kiddies Carnival Band, Morgana Beach, admitted to using recycled materials to produce costumes for 100 children.

She salvaged lace that a large band wanted to dump to produce some of her sections.

“People are not buying. I would say 35 per cent of the band is free because we know a lot of people can’t afford the costumes and want to enjoy Carnival.”

She admitted the payments of taxes were worrying.

Lakhan said he had to absorb the increase in customs duties on alcohol for his masqueraders.

He had budgeted one price for alcohol for his Antourage Productions band, but now it’s costing him double.

Calypsonian Michael “Sugar Aloes” Osuna said when you reach a certain age, “I doh think you does pay these things (taxes). Maybe that is for the younger ones. When I was younger, I used to pay it.”

Devon Seale, who pays taxes and health surcharge as an employee, wanted to know if the imposition of this new tax applies to him as a calypsonian.

He wondered if he would have to pay two sets of health surcharge fees under the IRD advisory.

“It’s a bit ambiguous,” Seale said.

Of the seven stakeholders we interviewed, none were visited by IRD field officers.

Related News

Iranian state TV issues first official death toll from recent protests, saying 3,117 were ...

Chaguanas Chamber reacts to ZOSO Bill failure

CAL: Airline was not evicted in Kingston