STATE-OWNED First Citizens Group Financial Holdings Ltd recorded a profit after tax of $957 million for the year ended September 30, 2024.

This represents an increase of 23.17 per cent from $777 million in the previous year.

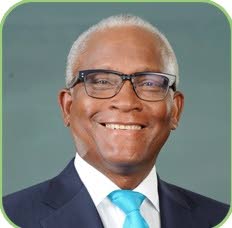

In a newspaper ad on December 3, First Citizens chairman Anthony Smart said the group's total assets stood at $47.1 billion, an increase of 4.84 per cent from $44.9 billion.

Loans to customers increased by over $1.1 billion or 5.37 per cent to $21.2 billion from $20.1 billion.

Earnings per share increased by 23 per cent from $3.08 to $3.79.

>

The directors, Smart said, have declared a final dividend of $0.88 per ordinary share for the final quarter payable on December 28 to all shareholders on record as at December 13.

This brings the total dividend for 2024 to $2.37 per share compared to $2 per share in 2023.

"This represents a year-on-year increase of 18.5 per cent in dividends to our valued shareholders," Smart said.

He added that these accomplishments were further complemented in October when global credit rating Standard and Poor's re-affirmed First Citizens Bank Ltd's investment grade rating of BBB-/A-3 with a stable outlook.