Early last Sunday afternoon, I received the following message by WhatsApp:

“Vincent Pereira has announced his retirement/resignation from Republic Financial Holdings (RFHL). I have known him for decades, and he has said that he is selling all his shares in the bank, and I should do the same. I am going to follow his advice; he has never guided me wrong. This is all because of government interference in a very, very successful BANK.

“Robert Riley and Jason Mootoo SC have also resigned from the RFHL board. Shareholders have lost value since the shares are down mainly because of the government’s plan to have RFHL absorbed by FCB. Take Mr Pereira’s advice investors; I know some powerful investors have already started pulling out.”

I sent that message to Mr Pereira, asking him whether it was fake news or if someone had breached his confidence. Mr Pereira read my message, but he did not respond.

I received the WhatsApp from someone who asked me simply, “Is this true?”

Following is my initial response to that person on Sunday afternoon.

“There is some truth to it.

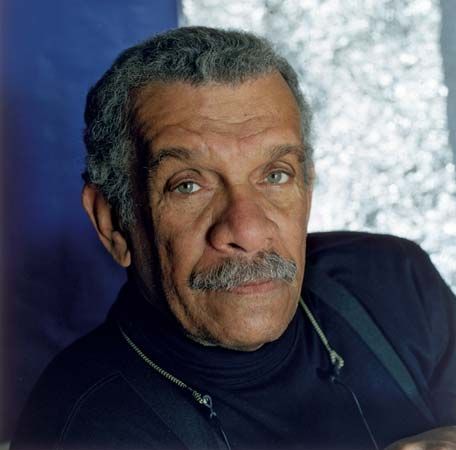

“As I reported on Saturday, Mr Pereira is 70, which I am told is the retirement age for RFHL directors.

“Mr Pereira owns 14,991 shares in his own name worth $1.54 million. That is less than 0.1 per cent of RFHL’s issued share capital.

“I DO NOT consider a shareholder voting its majority stake in a public company to enable a majority of directors to be “interference” in that company.

“I was told that two more directors are going to resign from the board shortly. Because my source did not name the resigning directors, I did not report that in my story on Friday.

“I doubt that the Government plans to have RFHL absorbed by FCB. I do not think the Central Bank, even under Mr Howai, would allow that.

“I also do not think ‘some powerful investors’ have already started pulling out of RFHL. From recollection, there has only been one large transaction in RFHL shares since April 28, 2025.”

These are the main takeaway points from this message:

1) That Mr Pereira has announced his retirement as the chairman of RFHL;

2)

I do not know Vincent Pereira personally. I may have met him twice during my 35-year career as a journalist. But I know people who know Mr Pereira well and who have attested to his probity, intelligence and integrity.

On reflection, I am absolutely certain that Mr Pereira did not tell anyone—and that includes his wife, siblings, his best friend from primary school or his dog—that he is selling all his shares in the bank and that the writer should also sell all of his RFHL shares.

I am certain that Mr Pereira did not tell anyone that he is selling his RFHL shares, because to have done so is illegal and could result in him paying millions of dollars in fines and spending the rest of his life in prison.

T&T has a Securities Act, which makes insider trading and market manipulation illegal offences.

Section 100 of the 2012 Securities Act stipulates: “No person connected to a reporting issuer shall, directly or indirectly, buy, sell, or otherwise trade in any securities of such reporting issuer, on a securities market, during any time that such person has knowledge or possession of material non-public information, however obtained, until such information has been published.”

Section 101 of the Act states: “A person connected to a reporting issuer shall not, directly or indirectly, communicate or otherwise disclose any material non-public information to any person until such information has been published, unless in the necessary course of business.”

And at section 102 the Act outlines: “A person who contravenes section 100 or 101 commits an offence and is liable on summary conviction to a fine of $10 million and to imprisonment for 10 years.”

Sections 100 and 101 of T&T’s Securities Act treats with the issue of insider trading or the “prohibition on use of material non-public information.”

According to the Act, material non-public information means, in relation to securities of a reporting issuer, any material fact or material change that has not been published.

The Act defines a material fact when used in relation to the affairs of an issuer or its securities as “a fact or a series of facts, the disclosure of which would be considered important to a reasonable investor in making an investment decision.”

A material change means “a change in the business, operations, assets or ownership of an issuer, the disclosure of which would be considered important to a reasonable investor in making an investment decision and includes a decision to implement such a change made by the directors of the issuer or other persons acting in a similar capacity.”

The retirement of the chairman of a publicly listed company is a material change as that would be “considered important to a reasonable investor in making an investment decision.” The sale of shares in a publicly listed by the director of that company is also a material fact that must be published.”

Since RFHL has not made public the fact that Mr Pereira is retiring from the bank, his retirement is material non-public information. For him to even confirm to anyone that he is retiring is a breach of section 101 of the Act.

On the issue of market manipulation, the Securities Act a section 92 (b) states that “no person shall enter into or carry out, directly or indirectly, any fictitious or artificial transaction or device, with the intention that, or being reckless as to whether, such transaction has, or is likely to have, the effect of maintaining, increasing, reducing, stabilising, or causing fluctuations in the price of securities traded on a securities market.”

A person who contravenes section 92 of the Act “commits an offence and is liable on summary conviction to a fine of $2 million and imprisonment for five years.”

So, I would imagine that having spent many years at the apex of corporate life in T&T—Mr Pereira was appointed as the chairman of Atlantic LNG as at October 1, 2024 and previously served as the president of BHP T&T—that he knows that premature disclosure of material non-public information is absolutely forbidden by the rules of modern securities trading.

Would he risk his reputation to satisfy the vicarious desire by someone who claims to be his friend for insider information on RFHL?

Very doubtful, in my view.

FCB absorbing Republic

I also think that the notion that FCB could absorb RFHL is ridiculous, as that would mean the Government having to find about $8.5 billion to buy the shares of the minority owners of Republic Bankplan is to have RFHL absorbed by the First Citizens Group (FCB).

It is also not on, in my view, that the Central Bank would allow Republic Bank to absorb FCB. That’s because RFHL and FCB are this country’s two largest financial institutions by assets. Bringing them together would mean creating a financial services company that is ‘too big to fail.’.

Investors selling RFHL

The Sunday WhatsApp messenger indicated that “some powerful investors have already started to sell their shares in the company.” If by powerful the writer means large, there is no evidence of large trades taking place in RFHL shares since the election of the administration.

Here is a list of the largest trades in RFHL since April 28, 2025

Date*Number*Price*Consideration

Nov 5*101,730*$105.61*$10.74M

Oct 10*201,286*$107*$21.53M

Sept 8*83,237*$106.89*$8.89M

July 11*230,680*$112*$25.85M

July 10*158,441*$111.92*$17.73M

June 25*102,339*$112.09*$11.47M

May 15*83,506*$112,07*$9.35M

My calculation is that there were seven large trades in RFHL shares since the general election at the end of April and that the total number of shares traded amounted to 961,219.

As RFHL’s issued share capital totals 163,839,311, the number of shares traded in what is likely to be large transactions amounts to 0.58 per cent of the financial holding company’s issued share capital.

Fact or fiction

The only reasonable conclusion for anyone who read that WhatsApp message to come to is that it was fake, concocted to destabilise the share price of what is this region’s largest financial services company.

Who stands to gain from such mischief?

No one, as everyone in T&T has an interest in the continued success of RFHL, given the company’s outsized importance in the investment portfolio of the National Insurance Board. As the owner of 30,811,955 RFHL shares, every $1 that the bank declines means a decline in the value of the NIB by about $31 million.

If the value of RFHL is hurt, the ability of the NIB to continue paying retirement benefits would be jeopardised.

Disclosure: The author of this commentary is one of tens of thousands of small holders of RFHL shares