Consultant Editor Investigations

After 15 years, the Central Bank’s civil case against the CL Financial (CLF) group began on January 6 before Justice Robin Mohammed.

Ten days later, last Friday, Attorney General John Jeremie announced that he is officially ending civil litigation by the State into the matter, even as he described it as the largest case of fraud and financial tragedy in T&T and possibly the Caribbean.

He then laid the Sir Anthony Colman Commission of Enquiry (CoE) report, which was in the hands of the Director of Public Prosecutions (DPP) as he pursued a criminal investigation into the group and its officers, in Parliament.

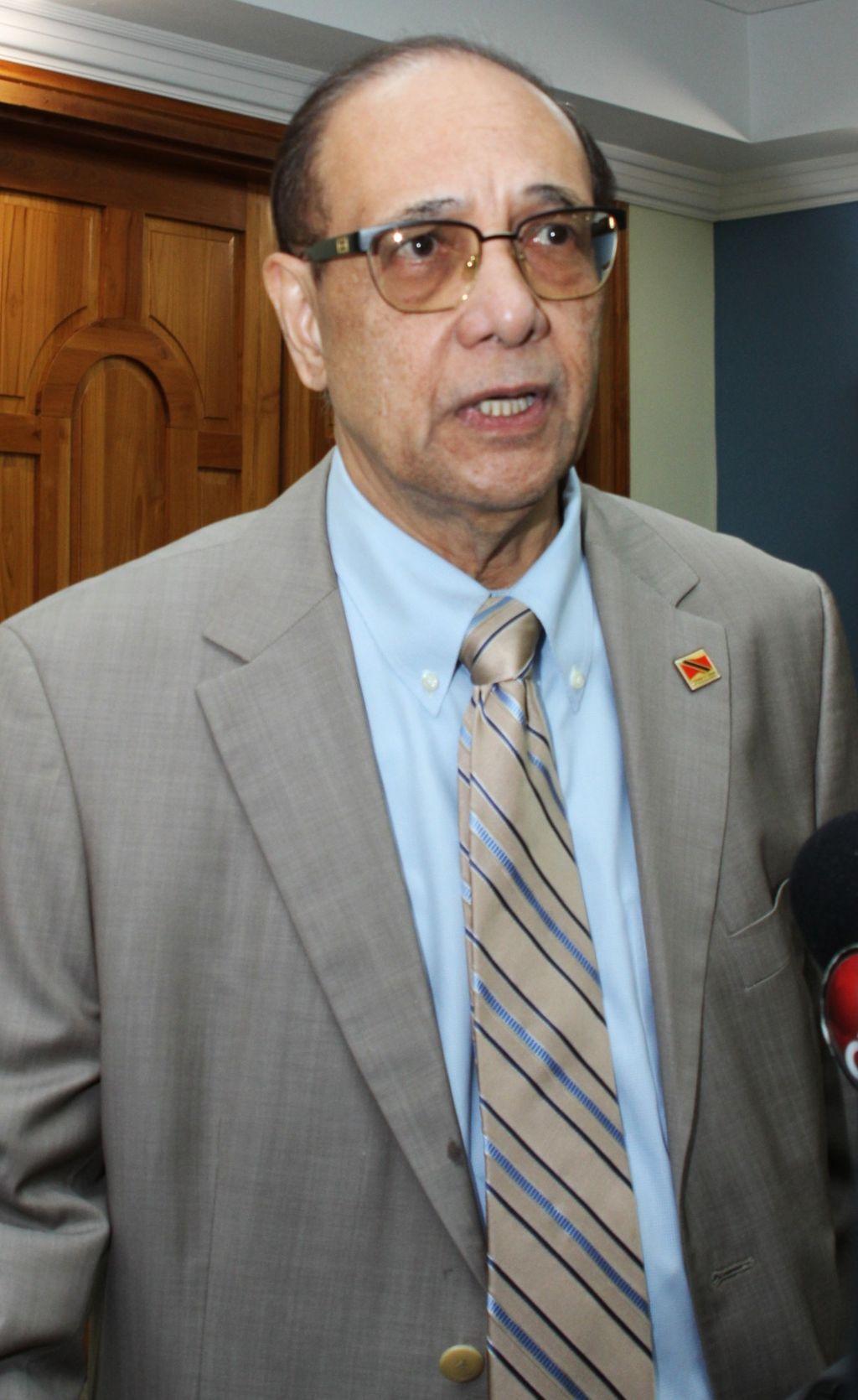

In a statement yesterday, Central Bank Governor Larry Howai said the Bank is giving its independent consideration to the wider implications for the ongoing litigation matter against former officers of the CL Financial group.

He noted that the report is voluminous (676 pages), and “the Bank is carefully reviewing and considering its full contents.”

“The Central Bank is admittedly concerned that the process is such a protracted one,” he added.

He said the Bank would provide more information as and when appropriate to do so.

The Central Bank’s matter against CLF includes its former executive directors Lawrence Duprey, Andre Monteil, and their respective companies, Dalco Capital and Stone Street Capital, and former CLF corporate secretary Gita Sakal.

The CBTT and Clico (which had been under CBTT management at the time) initiated civil action against CLF and its directors in 2011.

It began under former governor Ewart Williams and continued through former governors Jwala Rambarran and Dr Alvin Hilaire.

The officers are accused of mismanaging the company by misapplying and misappropriating the company’s income and assets to the detriment of policyholders and investors.

Through the lawsuit, the CBTT and Clico are seeking damages and restitution for the losses suffered by the company during the group’s tenure.

The case is framed around “fraud against the public” alluding to two Ponzi schemes, following investigations by forensic investigator Bob Lindquist.

In their statement of claim, CBTT and CLICO argue that the insurance company’s pre-2009 operation was grossly deficient and egregious in the following (and other) respects:

The interests of policyholders and mutual fund investors were subordinated to the interests (and demands) of others, in particular the private interests of Mr Duprey and Mr Monteil;

Returns offered on products and related costs were excessive and unsustainable;

Money invested by policyholders and mutual fund investors were improperly disbursed, including: (a) to fund Mr Duprey personal needs and lifestyle, as well as those of other members of his family and private companies; (b) to fund ventures by other companies which were not in the interests of Clico but rather in the interests of Mr Duprey and Mr Monteil and companies related to them; (c) to fund CLF notwithstanding its failure to repay previous indebtedness to Clico; (d) to fund CIB by way of providing deposits and a bond, notwithstanding its failure to repay previous indebtedness of Clico.

Clico’s assets were improperly dealt with;

Clico was improperly exposed to liabilities unrelated to its interests;

Clico was improperly caused to provide security for transactions unrelated to its interests;

Clico was improperly caused to provide an interest-free current account facility to CLF; and,

Assets were not matched to liabilities, in particular in order to generate the sums needed to pay the rates of return contractually due to policyholders and mutual fund investors.

The statement of claim also said that there was no proper governance of Clico (nor of CLF and CIB).

The claims also alleged that Mr Duprey and Mr Monteil operated or procured the operation of two types of Ponzi schemes:

“Internal Ponzi Scheme: Mr Duprey and Mr Monteil procured improper diversion and misappropriation of CLICO’s money, including policyholders’ money, in order to fund CIB and/or CLF and/or other group entities, often in return for worthless or wholly inadequate purported consideration and/or security. They did so in circumstances where they knew or should have known that there was no or little prospect of return. They knew or ought to have known that CLF and CIB were each (a) highly dependent upon Clico not seeking repayment of principal and accumulated interest on existing indebtedness from them, as well as dependent upon Clicofor further funding and (b) unable to pay its debts to Clico as they fell due.”

“External Ponzi Scheme: Mr Duprey and Mr Monteil procured improper dealing with new money from policyholders and mutual fund investors (i.e. money from new policyholders/investors and new money from existing policyholders/investors), including improperly funding redemptions and repayments to existing policyholders/investors, without sufficient or any proper regard to what was required to fund future liabilities to them.”

Related News

Tobago’s 2025 low murder rate is sustainable—retiring senior cop

Venezuela condemns US military attacks on Caracas

Man held with gun tells police: ”I have it for protection”