Lee Anna Maharaj

leeanna.ma[email protected]

As the increase in traffic fees continues to draw public attention, the reality of some other fees is also raising concerns, particularly those affecting businesses.

For instance, the cost of a work permit is now $900 per month. That is $10,800 for one year, and in addition to an application fee of $1,200, bringing the total to $12,000. For two years, the fee is $22,800 and for three years, $33,600.

WORK PERMIT FEES

Duration Previous Fee Current Fee

12 months $6,000 $12,000

24 months $11,400 $22,800

36 months $16,800 $33,600

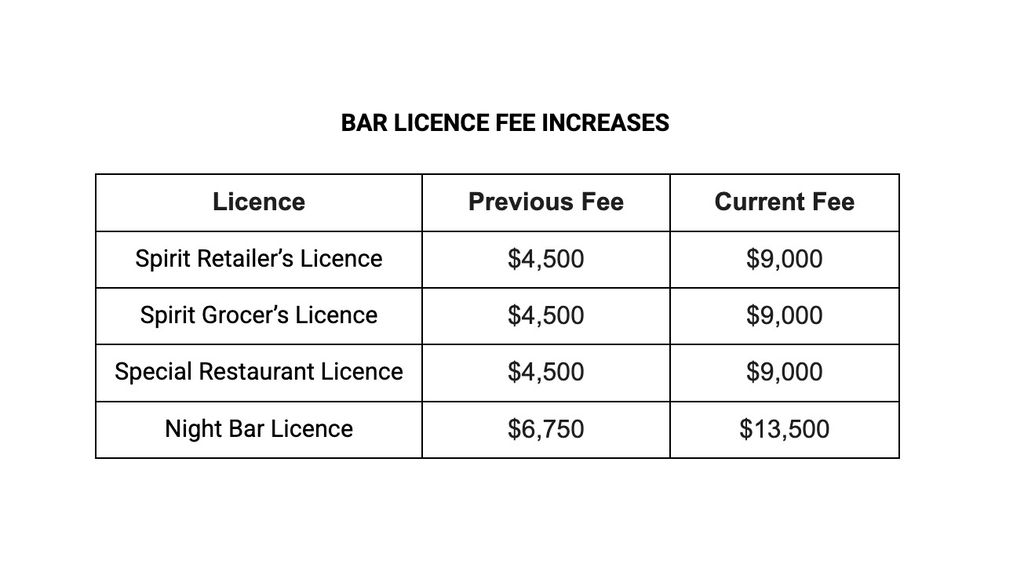

Store owners will also feel the impact, as the Standard Bar Licence, the Spirit Grocer’s Licence and Special Restaurant Licence fees were all raised to $9,000, while the Night Bar Licence fee was increased to $13,500. These fee increases apply to liquor sellers in all areas.

BAR LICENCE FEE INCREASES

Licence Previous Fee Current Fee

Spirit Retailer’s Licence $4,500 $9,000

Spirit Grocer’s Licence $4,500 $9,000

Special Restaurant Licence $4,500 $9,000

Night Bar Licence $6,750 $13,500

Also seeing a major increase are businesses with gaming machines. Taxes on amusement gaming machines, such as arcade video games and claw machines, have increased from $6,000 per machine per year to $25,000 per machine per year, while taxes on electronic roulette devices have increased from $120,000 per machine per year to $200,000 per machine per year.

GAMING TAX

Tax per machine, Previous Fee Current Fee

per year

Amusement Gaming Machines $6,000 $25,000

Electronic Roulette Devices $120,000 $200,000

Additionally, a 10 per cent customs duty fee and 12.5 per cent VAT for high value electronic vehicles have been introduced. These vehicles will also be subject to a tiered rate for their motor vehicle tax.

Meanwhile, the age limit for importing used petrol, diesel or CNG vehicles has increased from three years to eight years, and for light commercial vehicles, it has been moved from seven years to 10 years.