Finance Minister Davendranath Tancoo is standing by his decision to amend the Liquor Licences Act to update the gaming tax fee and revise duties payable for liquor licences under the Second Schedule.

He spoke on the issue in Parliament yesterday as he piloted the Finance Bill 2025.

“Mr Speaker, we are now increasing the annual gaming fees under Section 20B as described in the documents before you, in the multi-billion-dollar industry, which remains unregulated. I am advised that the vast majority of these machines have been in operation for over a decade and have not been registered,” Tancoo said.

The Trinidad and Tobago Coalition of Bars and Restaurants and the Barkeepers Owners and Operators Association have warned that the Government’s proposed increase of the Amusement Gaming Tax from $6,000 to $25,000 per machine per year could devastate small and medium-sized bar businesses.

They say the hike of more than 400 per cent would make legal operation impossible for hundreds of community-based bars, risking closures and thousands of job losses. According to the bill, the annual gaming tax would rise from $60,000 to $250,000, an increase of $190,000 per year, which they say exceeds the total net profit of many small and medium-sized establishments.

Industry representatives warn this could shrink the legal gaming sector, reduce government revenue from VAT, NIS, PAYE and liquor licence fees, and push activity underground. Former finance minister Colm Imbert also pointed to other measures, including a first increase of NIS contributions to 19.2 per cent, taxes on plastic bags, quadrupled gaming licence fees, higher electricity charges for commercial users, and increased fees for brewing beer and rum.

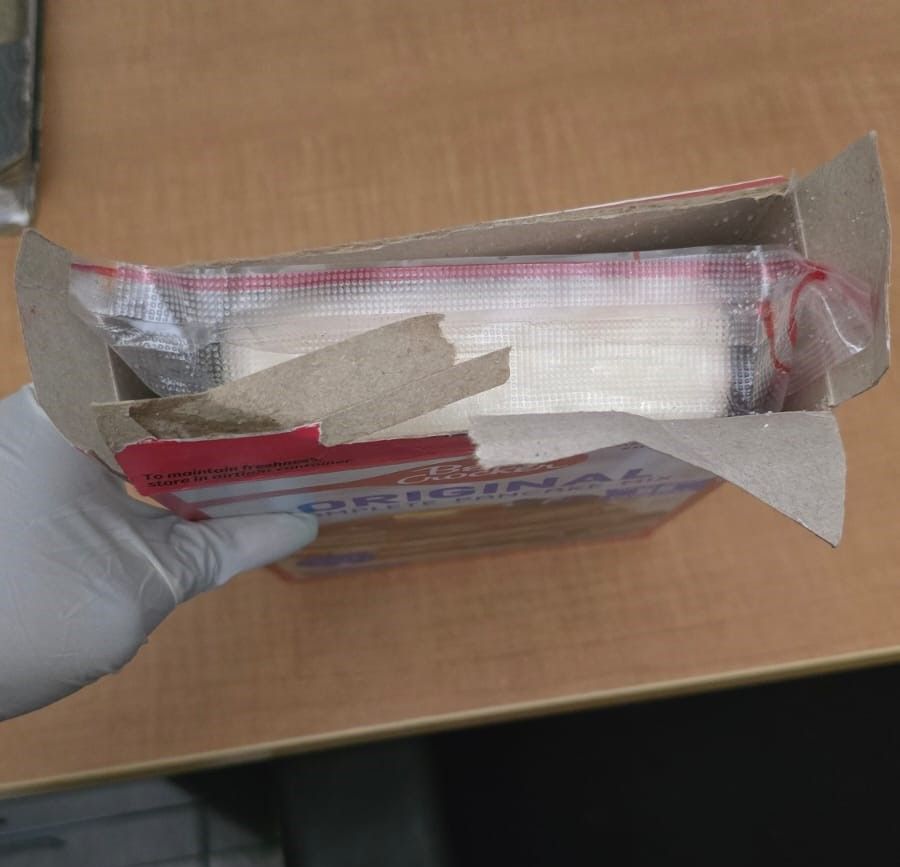

Tancoo also addressed Clause 3 of the act, which amends the Gambling and Betting Act, Chapter 11:19, to modernise the offence structure and strengthen penalties for illegal lottery activities.

“Mr Speaker, when we assumed office, we were advised by members of the Police Service that illegal gambling levels were significant and it was also tied to a series of other illegal activities, including money laundering, human trafficking, tax evasion and prostitution.”

He said the Government had to take immediate and informed action to crack down on illegal practices by focusing on both prevention and deterrence.

“For too long, illegal gambling has thrived due to low and outdated penalties which fail to reflect the scale of the problem and fail to address the crises that it caused,” Tancoo said.

“By increasing penalties and making clear that these offences attract serious custodial sentences, this Government is sending a signal, an unmistakable signal, Mr Speaker. All illegal lottery activities will not be tolerated.”

Opposition MP for San Fernando East Brian Manning called the tax “ridiculous” during his contribution yesterday.

“I saw members of that industry say in the media this would be an extinction-level event for their small, honest businesses with this draconian increase in taxes,” Manning said.

“Even big businesses in south saying they have to shut down their businesses because of taxes on gaming machines and taxes on liquor at the bar.

“If the member had paid attention in business school, he would know many of these businesses, restaurants and so on, get profits from the bar. Not from the door.”

Manning said enforcement remained a major concern.

“Mister Speaker, this increases fines, penalties and the taxes for illegal lottery. Great. Mister Speaker, as we said earlier, who is going to enforce the law to ensure that these taxes are collected? The minister said nothing about that. He thinks is magic! He just writes this piece of paper here, make it law and the money going to appear. That is not the case,” Manning said.

Outside Parliament yesterday, Guniss Seecharan, a member of the Bar Owners Association, questioned what he described as the Government’s focus on bars. Seecharan said many bars already struggle with high operating expenses and accused the authorities of targeting one sector repeatedly.

He asked why other high-earning professions and institutions were not being targeted with similar measures. Seecharan said bar owners accepted that alcohol prices were rising, expected an increase in licence fees next year and were now facing sharply higher taxes on gaming machines.

He also questioned whether larger casino interests were influencing policy, adding that he could not say for certain but remained concerned that bars were being treated as a primary revenue source.