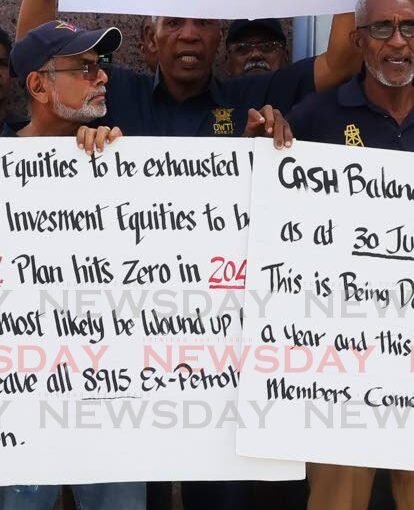

Petrotrin protestors on Park Street in Port of Spain on Friday. PHOTO BY FAITH AYOUNG -

Petrotrin retirees staged a noisy placard-protest along busy Park Street, Port of Spain on November 22, expressing their fear that mismanagement by the government could see their pension fund – which they have contributed to over their decades of service – dry up by 2043.

The retirees were supported in their protect by members of the Oilfield Workers Trade Union (OWTU). They are demanding reformation of a management committee and intervention by trustees.

This protest was staged, and the pensioners' demand made, amid fears of a growing deficit in the fund that threatens the livelihood of current and future pensioners, said union member Ernesto Kesar.

Kesar who is the OWTU's executive vice president claimed the Petrotrin employee pension plan, which at its peak was valued at $9.3 billion, had shrunk to $6.9 billion – a deficit of $4.2 billion. He said this was revealed by actuarial firms which reviewed the fund.

Kesar said the pension plan could run out of funds by 2043 if no action is taken. He said retirees are reliant on a plan that has been neglected by Petrotrin since the refinery's closure in 2018.

>

“Pensioners have not received any increases to keep pace with inflation”

However, Kesar claimed, the Petrotrin executive staff's pension plan remains fully functional and is very well-managed. This he said reeks of discrimination.

He said the absence of a management committee and trustee oversight since 2018 has caused the general pension plan to deteriorate.

Victor Joseph, a Petrotrin retiree since 2007, said the fund’s mismanagement has caused him much distress.

He said retirees once received increases to their pension every three years, tied to the plan's investment profits. However, since Petrotrin’s closure, no contributions have been made by government or the company.

“Trustees have resorted to liquidating foreign investments to pay pensions and are expected to start selling local investments by 2025. This depletion risks the complete collapse of the plan.”

Joseph said government failed to honour commitments made during Petrotrin’s closure to adequately fund the pension plan.

“Retirees are not at fault for the closure of Petrotrin, but are now suffering due to unfulfilled promises.”

Kesar accused government of misleading the public on the state of the pension fund.

>

“The plan was not in surplus as was claimed, and now taxpayers may bear the financial burden if idle assets are not utilised to address the deficit,” Kesar said.

OWTU, he said, is calling for the re-establishment of a management committee to oversee the pension plan, alongside intervention from Republic Bank who supervises pensions on behalf of the Central Bank, and other stakeholders.

“The financial strain on the pension fund is causing anxiety and uncertainty among retirees and their dependents,” Kesar said.